KEY POINTS

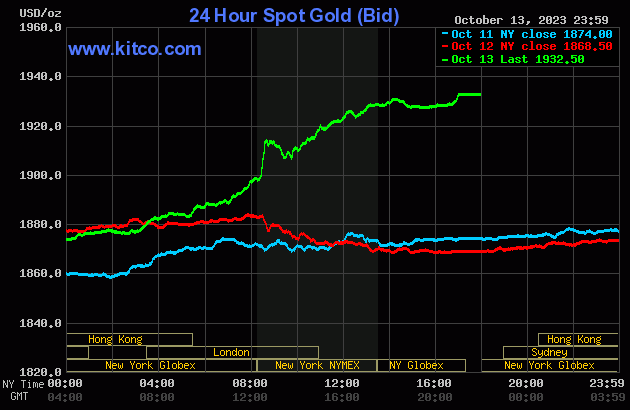

- Gold up US$64 to US$1932

- Closed near the highs

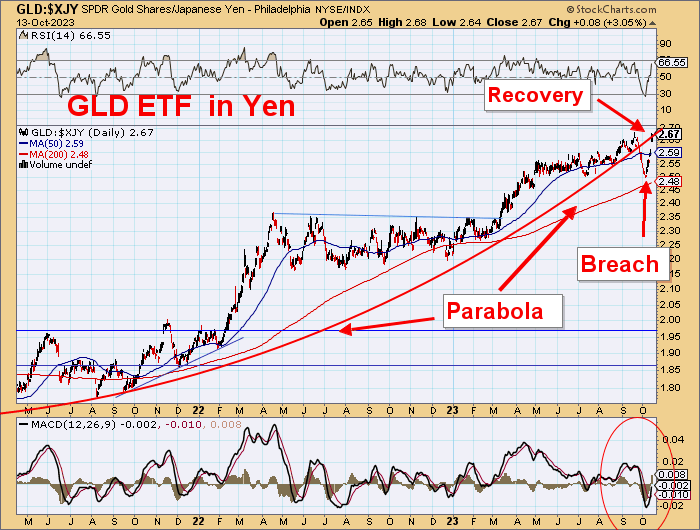

- Gold in other currencies regained parabolas

- Starting next 60-year cycle

- Soon to test previous highs

- This is a Wave 3

- Short covering should be very strong

- Gold stocks up 4.5%

- Important cyclical low in place

- Expect 100% returns over next 12 months

- ASX Gold stocks ready to break higher

- Flag formed for RHS

- Leaders to lead

- NST

- EVN

- DEG

- BGL

- Buy high-leverage plays

- RRL

- WGX

- DEG

- CYL

- NVA

- SPR

- PNR

Best explorers/developers

- AUC

- AUT

- BC8

- ICL

- SXG

- SNG

- LGM

- TRM

- FG1

- BGD

- OBM

- TOK Tolu Minerals IPO

- Closing Friday, October 30

- Link to prospectus Prospectus | Tolu Minerals

A strong performance by gold on Friday as it passed easily through US$1900 and now looks to be on its way to new all-time highs in the very near future.

As you know from these commentaries, the gold market has been through a lot over the last few years.

The price has been volatile and sluggish despite the positive fundamentals of supply and demand where central banks have been buying at record rates, China and India continued to buy Western gold, the man in the street continues to buy up coins and bars, and the supply of newly mined gold is still sluggish.

Also, against the background of fiat currencies continuously undermined by politicians hell-bent on printing money and creating even more debt and making the rationale case for gold even stronger.

That 180,000 tonnes of gold sitting in vaults or tied up in jewelry dwarfs what happens to that annual 3 - 4000 tonne of newly mined or recycled gold as it is absorbed into the marketplace.

Gold is now no longer driven by the US$ or interest rates. Everyone needs to understand that this is the beginning of something very big.

So, it is that vast stock of gold that influences the price.

But of course, it's so much more complicated than that because there are things called futures contracts and non-exchange structured and derivative products, and these can affect the price of gold at the margin.

It is fascinating to see that gold has exceeded US$2000 and tested ~US$2090 on three occasions over the past three or so years.

And gold prices in most currencies have continued in their parabolic rises.

All are very positive at every level. Yet, market sentiment has been in the cellar. Looking at the gold markets closely forces you to the conclusion that the gold market has really been suppressed.

Who and for what reason? We can only speculate, but it has been very obvious.

However, these past 12 months have been very different, as has been pointed out here, and the difference between gold prices today and gold prices over the last six years relative to the real U.S. interest rate is quite revealing.

It was flagging the change from gold being under the control of holders playing with the stock of gold to a market showing a better reflection of supply and demand.

Everyone knows the analogy of the beach ball held underwater and allowed to bounce right out of the water. That now applies to gold. The activities in Israel, with the attacks by Hamas from the south and now by Hezbollah in the north, are very ugly and have the potential to create something really nasty.

Let's hope sanity prevails, but some of the commentary is very inflammatory. These actions have caused a run to gold, but the bigger picture is that the change has been quietly underway for the past year, and this is the trigger to send gold much higher.

The trigger is not to encourage everyone to go out and buy gold because the sky is falling but rather to force the covering of massive short positions that have been built up during this period of price suppression.

Gold is now no longer driven by the US$ or interest rates. Everyone needs to understand that this is the beginning of something very big.

The buying that is likely to come in at US$2100 is very large.

The ending of the 60-year Gann cycle in gold in December 2023 will be seen to be a major event as gold heads higher for much of the next 60 years.

Heading higher for much of the next 60 years!

The sentiment levels in North America, as has been shown here so often, are equally abysmal, and so all this draws you to one simple conclusion. The marketplace is considerably underweight in gold and gold stocks.

Gold is the punisher. It will punish free-spending politicians and bureaucrats. There will be a return to some sort of gold standard that will mean the end of deficit spending and the spiraling out-of-control debt.

It is amazing that the world is finally waking up to the fact that so many of the leaders in the world today are basically incompetent rogues, and many are true criminals.

So many of their policies are for themselves and against their own people, so these elected/selected are seeing their days are now numbered.

This is obvious in the U.S. and especially in Canada, but the currencies are showing that Europe, UK, and Japan are heading into major problems as the politicians have destroyed sound money.

Here too.

The Voice Referendum in Australia has been fascinating.

It really did show the incompetent leadership on so many levels.

Half-baked ideas, poorly explained, no proper consultation, atrocious planning, and hoped to be supported by celebrities who told you the vibe was the key issue. And the true intention is hidden.

The impression that the government worker electorates in Canberra, Sydney, and Melbourne voted with >70% YES turnouts and those regional areas with large Aboriginal populations with <20% is lasting.

The growth of the unelected bureaucracies is clearly seen here as the foisting of so many useless, uncommercial, and inappropriate policies and programs on the electorates.

Incompetent Leadership

No wonder climate change and Net Zero get strong support along with COVID and immigration policies — the bureaucracies and NGOs in the capital cities run the show.

And they clearly do not know better.

Let there be an audit of this charade and of the whole guilt industry.

Gold will be helping change all that. Sound money is the key. It has to come.

Probably the most significant feature of gold has been the bewildering lack of interest in gold shares at a time when the gold price is so high in most currencies.

You will recall the commentary from the last Diggers and Dealers in Kalgoorlie in August that no one was interested in gold. They were all chasing the new-age metals. The performance of gold stocks, especially the developers and the explorers, has been pretty woeful, and we have all felt it.

It doesn't really matter how you look at it all; gold stocks are extremely cheap compared to gold.

The sentiment levels in North America, as has been shown here so often, are equally abysmal, and so all this draws you to one simple conclusion. The marketplace is considerably underweight in gold and gold stocks.

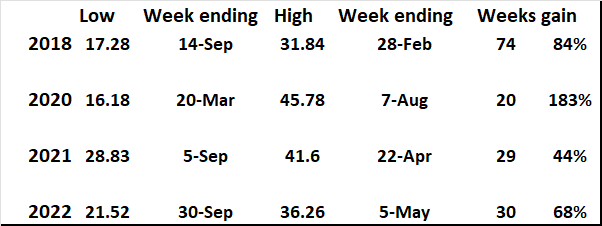

There is a massive catchup coming. Do note again that the average gain from a low in market sentiment in the last four cycles was 95%.

Friday's sharp rise has taken us to some important downtrends where gold and gold stocks might need to take a breather.

But probably not.

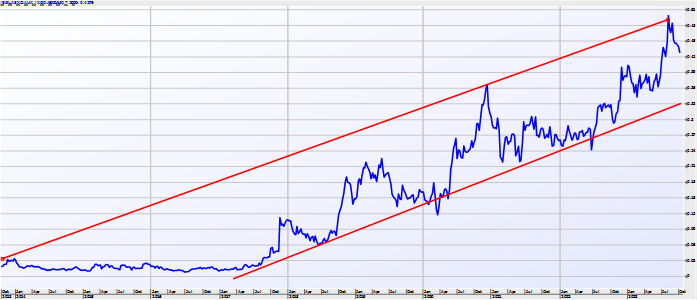

The longer-term parabola is here with gold, and the break through the top of the box should be extraordinary.

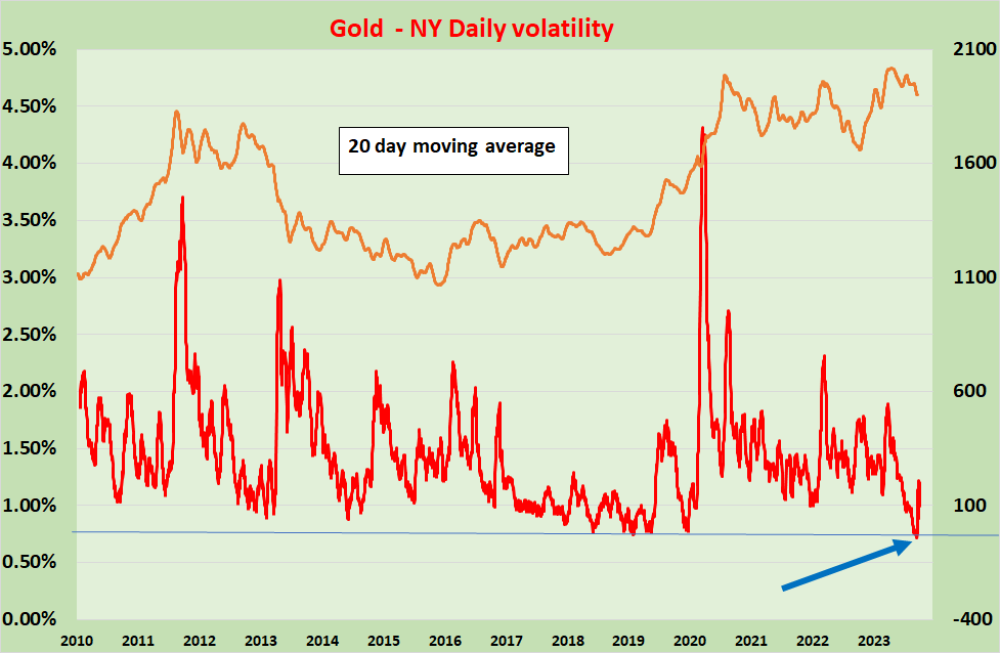

Daily price volatility is starting to increase, and as noted last week, a 5% price move at these levels is almost US$100.

This price jump has brought gold back above the trend lines and parabolas in most currencies.

Note this pennant formation for gold in Euros is suggesting a very strong move in gold in this currency.

And probably a very weak currency.

The recovery in gold in Yen has been achieved.

Gold Stocks

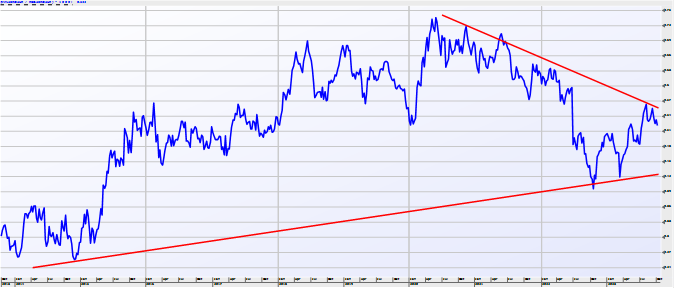

This index stopped at the downtrend line.

This week, we will see this broken.

The sentiment in the gold market has been in the cellar.

This is just another cyclical low, but where we go this time, I think, will be very different.

A very important buy signal was given here.

And so much is here to remind us of that false breakdown at the end of the 2011-2016 bear market.

Many similarities.

The recoveries from those lows were spectacular.

So here in Australia the gold price recovered back into the parabola.

And the XGD Gold Index is still looking technically very exciting.

A flag pattern has developed on the RHS that should see a 17% gain to the `neckline' at 7700.

And then a run to 12,000 fairly quickly.

The bigger stocks are looking good, but these smaller ones are really ready to go.

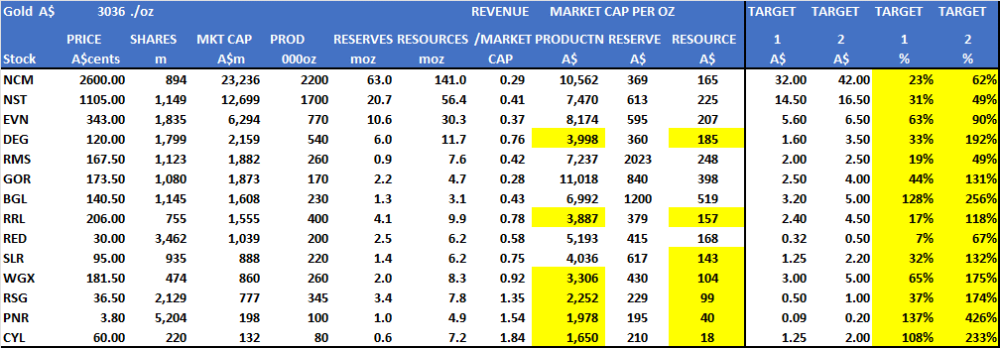

These are the MPS preferred universe of bigger gold stocks.

With some price targets.

Focus on revenue/market cap for a measure of leverage.

Look at market cap/oz for annual production.

Market leaders looking good.

- NST

- EVN

- BGL

- DEG

Best value and leverage plays

- DEG

- RRL

- WGX

- CYL

- NVA

Performances vs. XGD Gold Index

NST - Now the Market Leader

- About to lead the market higher still

EVN - Playing catchup.

- It should also outperform

RRL - will they close out the hedges this week?

- Very big outperformance coming

BGL – Stellar performance.

- Commencing gold production this Qtr

- Grades will far exceed DFS

DEG – Funds raised and moving to construction

- Exploration continuing outside Hemi

- At the bottom of the range

RMS – Great performance

- Rerating continuing

WGX is coming together very nicely.

- Output rising, costs being cut, cash building and exploration pushing

CYL – Super cheap

- Time for massive rerating

NVA – 10moz and getting better

- Gold for AU$5/oz

- Big outperformance coming

Head the markets, not the commentators.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.